By Sam Hopkins, Vice President, Tellepsen and Scott Parker, Vice President and Chief Estimator, Tellepsen

The current construction market is in the midst of a turbulent cost inflation climate that has led to increased construction costs. Our goal is to always remain predictable in not just a performance capacity, but in our ability to accurately forecast job cost.

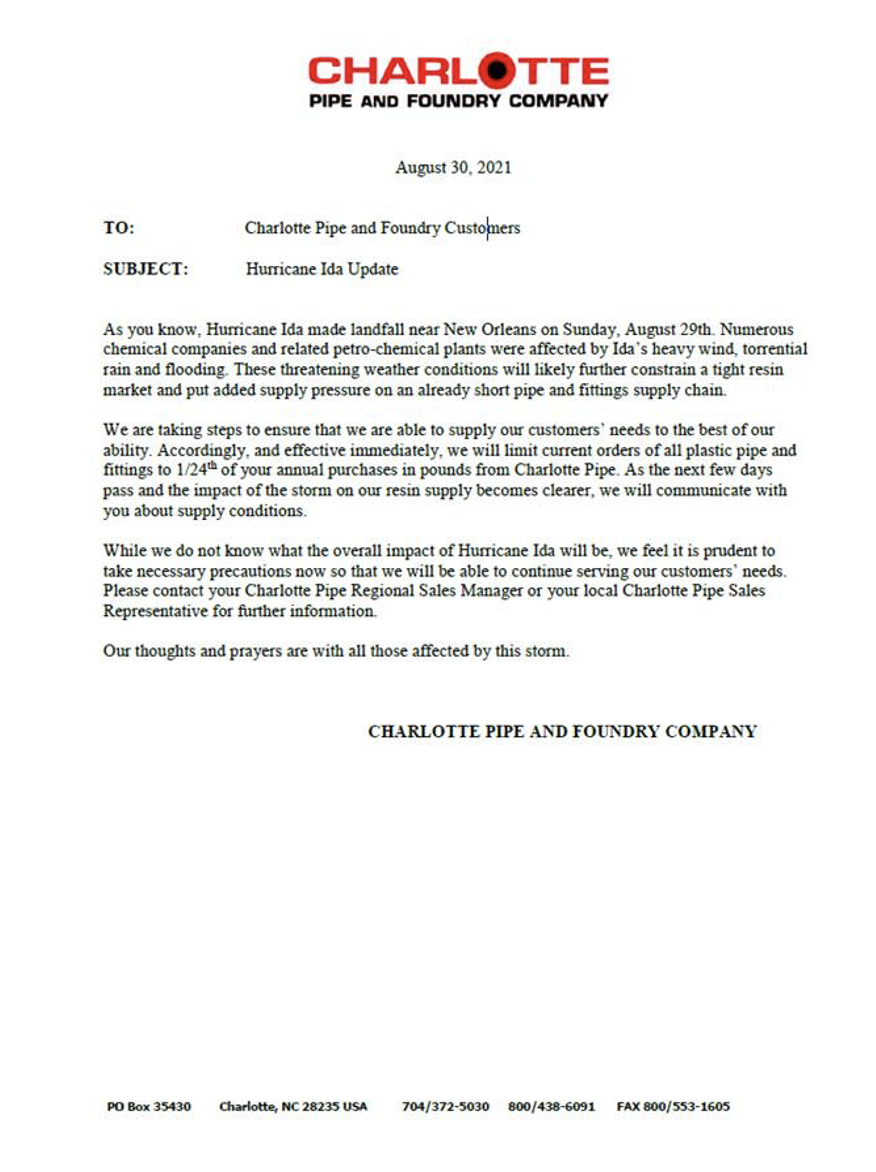

Recent events in the United States and around the globe have had a sudden and significant impact on raw materials costs as well as the overall supply chain procurement, these events include: Rebuilding inventory, federal trade tariffs and quotas, reduced supply chain capacities due to covid-19 pandemic reduction of manufacturer labor, regional winter events and transportation issues. Not to be left out, Hurricane Ida’s tragic impact on the country has also influenced the petrochemical production on the gulf coast and will have negative inflationary cost to the plastics that are used in construction (PVC, Resins, HDPE, etc) – Reference notice from August 30, 2021 from producer Charlotte Pipe and Foundry Company.

Escalation is a process whereby a number increases in intensity or magnitude over time. It is an uncontrollable variable. In other words, the escalation will occur despite the efforts of all parties involved in the project. It must be anticipated and addressed through a combination of the following: contingency and escalation allowances, value engineering analysis, early procurement packages and, lastly, alternate building components.

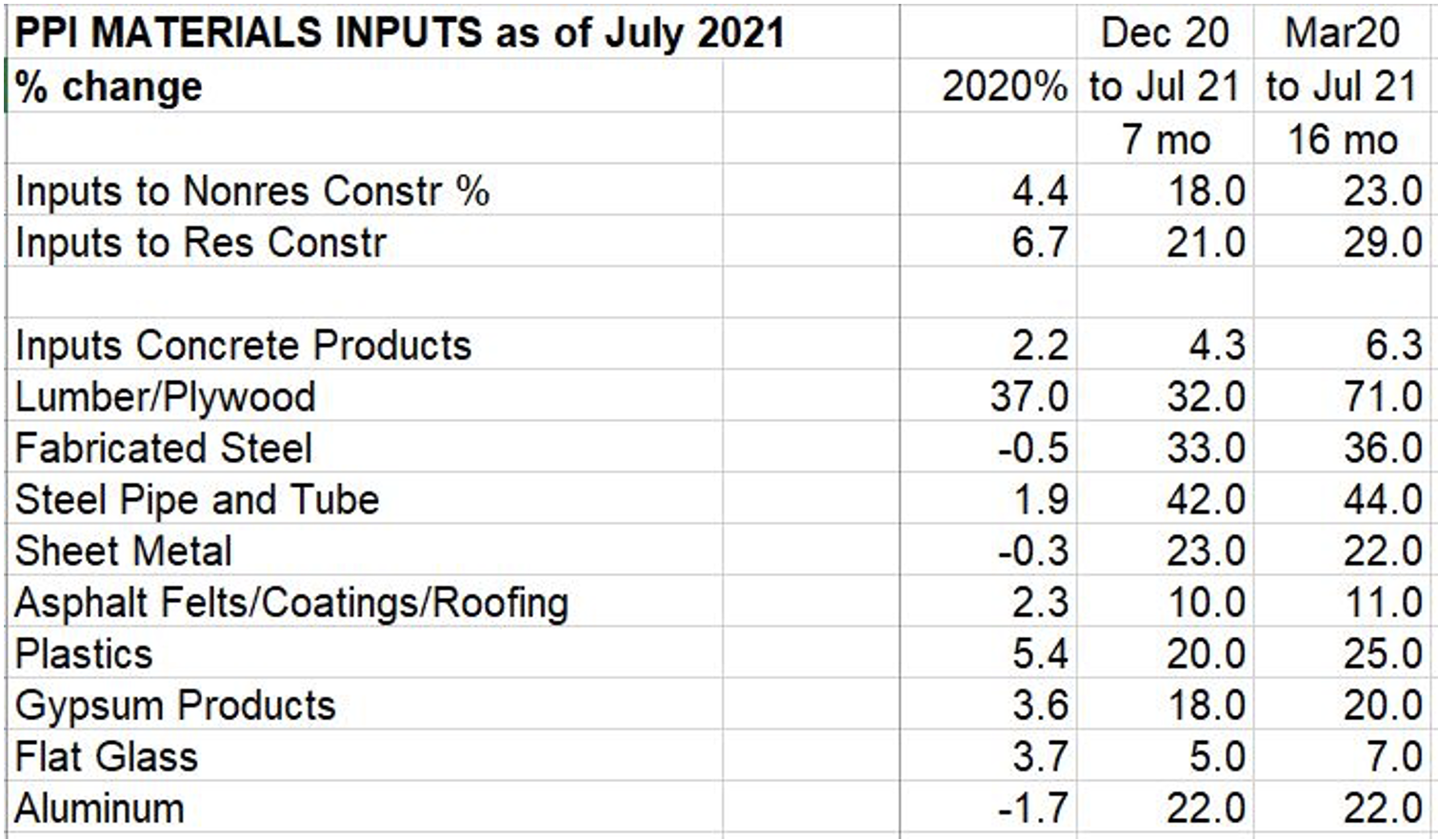

The graph below is helpful to show the impacts of construction inflation from two separate points in time (Dec. 2020 to July 2021 and March 2020 to July 2021). The commodities listed are not all encompassing of the complete construction process, but give insight.

*** Graph and data are credited to Ed Zarenski

Reuters posted an article earlier in the year that stated the US Manufacturers output dropped to the lowest state since 1946 because of supply chain issues and coronavirus pandemic restrictions. We are seeing demand for products outpace the supply of these needed construction materials and equipment. Long lead times are not only impacting schedules, but as schedules increase in duration or are accelerated to meet required end dates, the cost is again influencing an increased state of cost inflation for our industry.

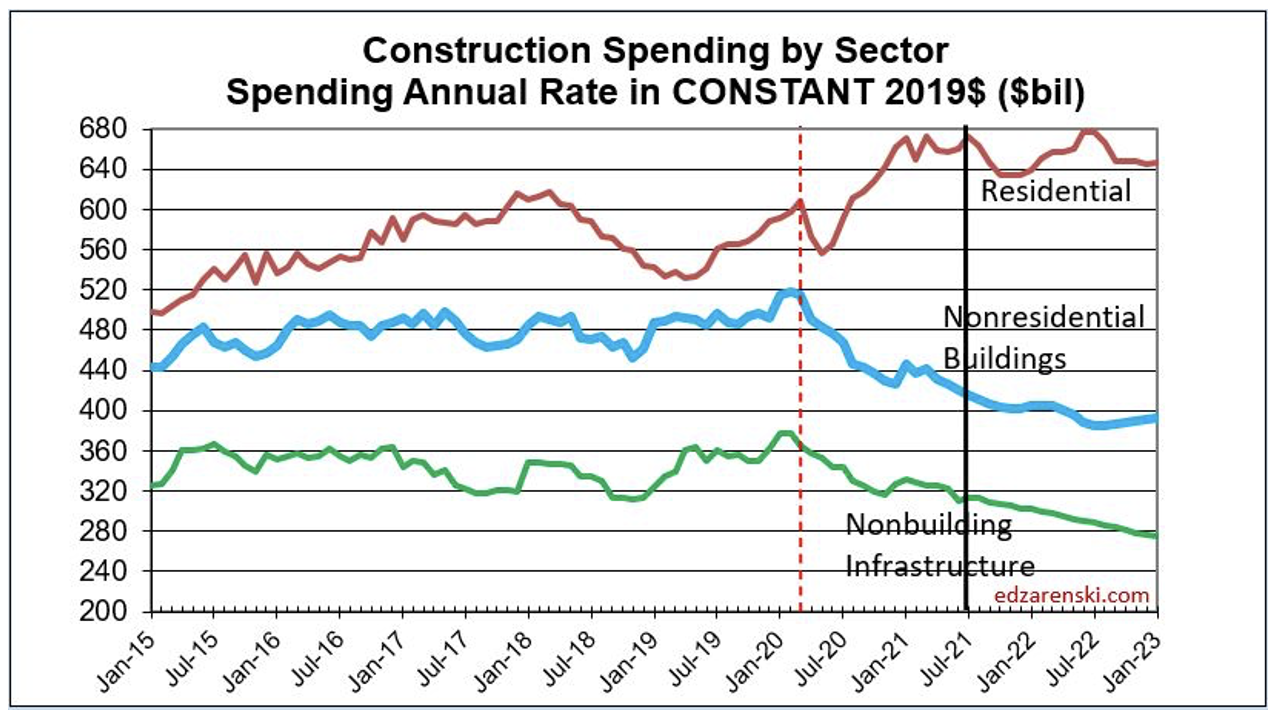

The graph above demonstrates the decline in revenue for Nonresidential construction which supports the belief that many bidding projects that were put on hold in 2021 will likely re-enter the bidding market in 2022. Intuitively, when these projects are put back into the bidding market, the market could be flooded with opportunity and contractors will have more choice and opportunities and will likely result in higher margins. If this happens, it would have an inflationary effect.

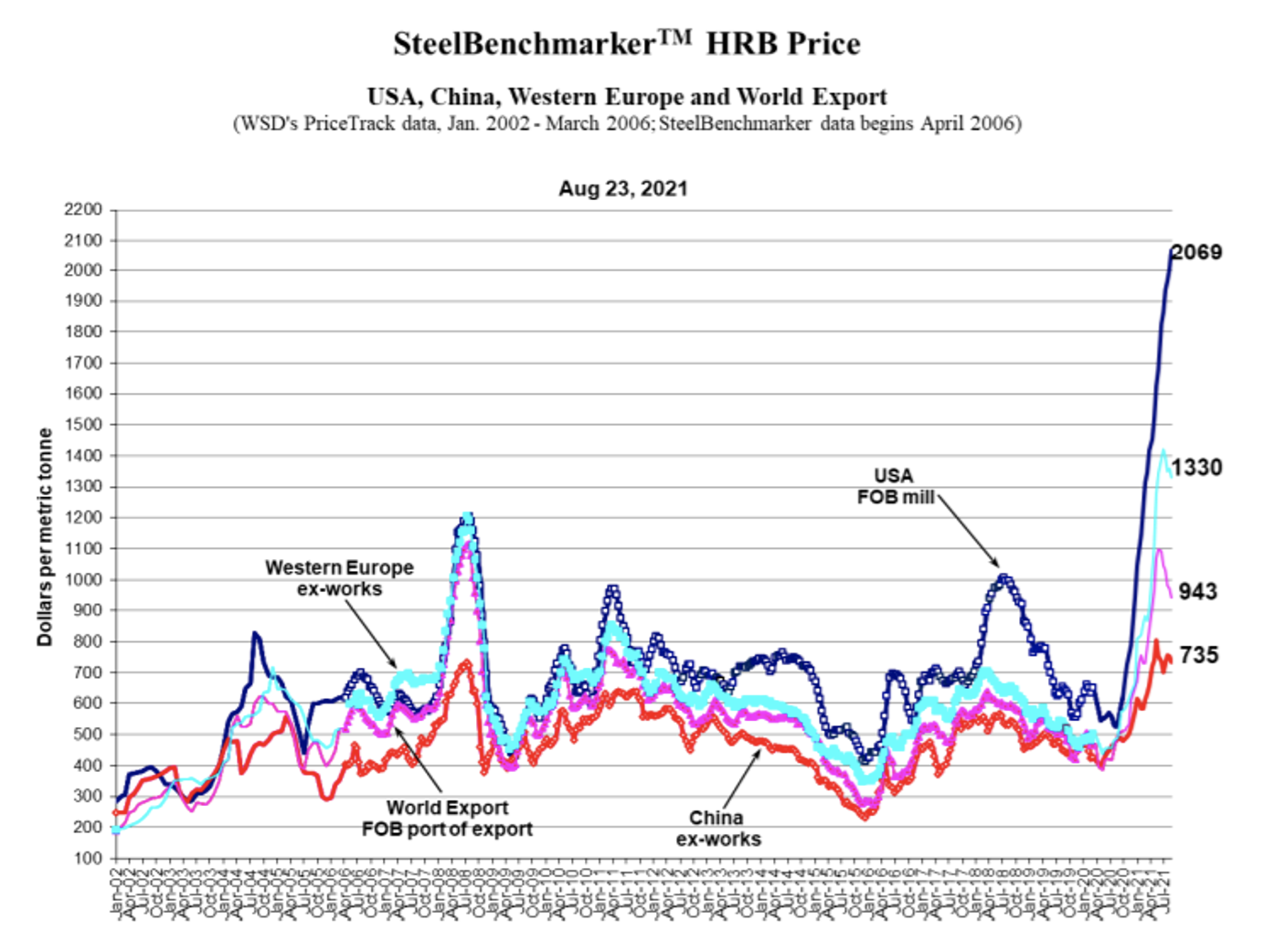

Steel prices at the mill are up 60% plus over the course of the last six months. The USA Hot Rolled-Band experienced it’s 25th consecutive increase as published by SteelBenchmaker on August 25, 2021. This would suggest that structural steel mill costs are still on the rise and it is uncertain as to when we will see relief from a construction inflation standpoint with respect to this major data point.

This will affect the cost of structural shapes, steel joists, reinforcing steel, metal deck, stairs and rails, metal panels, metal ceilings, wall studs, door frames, canopies, steel duck, steel pipe and conduit.

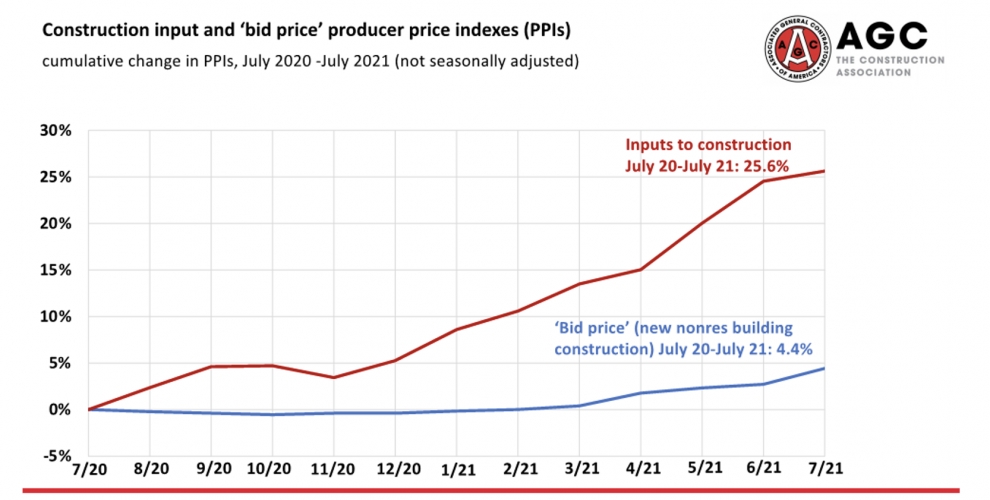

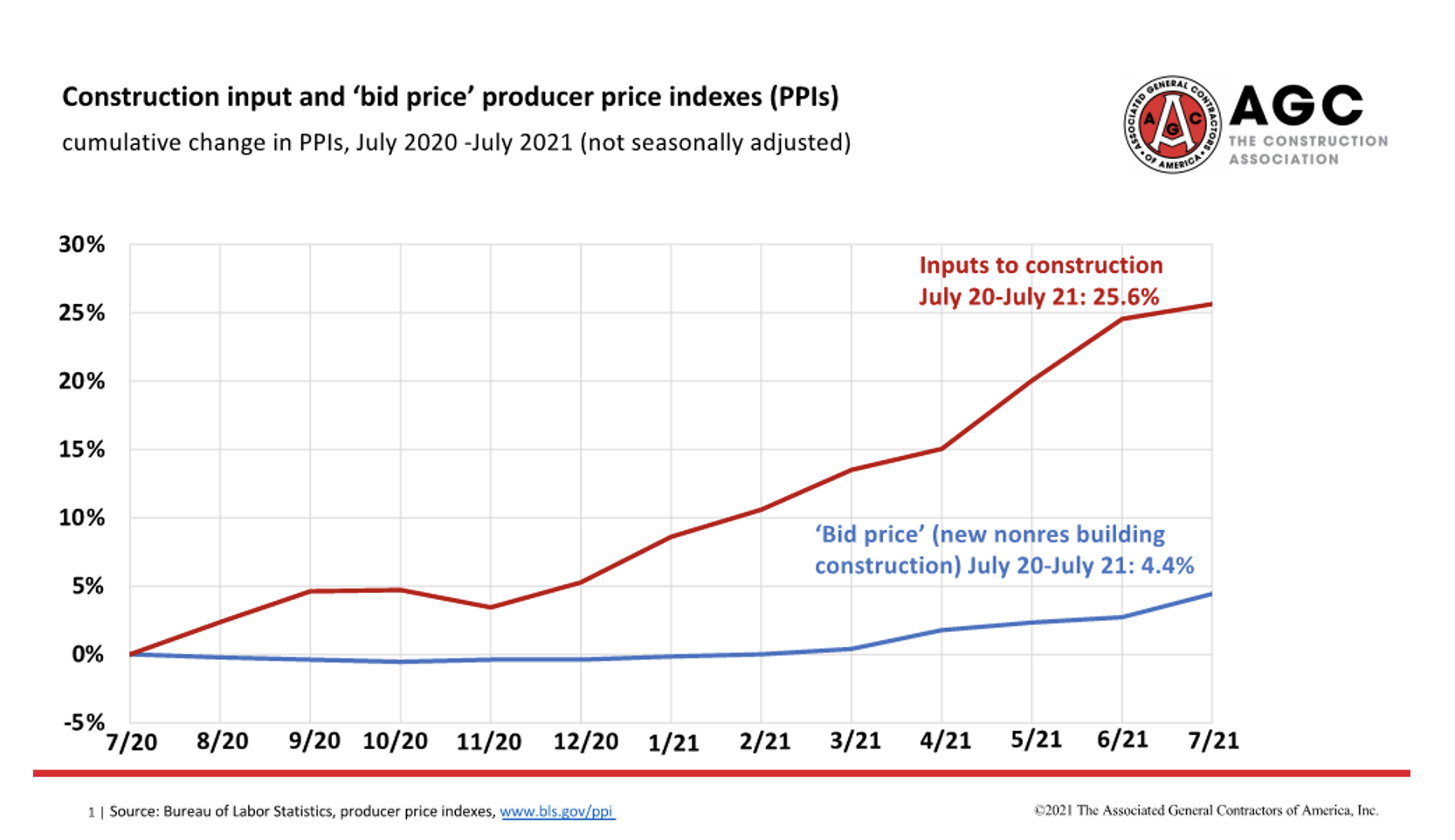

There is another unfortunate risk to cost inflation that the AGC is tracking with the producer price indexes (PPIs) below is the fact that bidders, subcontractors and contractors, are seemingly absorbing the majority of construction material cost inflation into their price – my opinion is that they are taking on risk by offsetting costs with their margins. This is concerning as they will have less contingencies in a turbulent market and could likely lead to project defaults that prime contractors and owners alike will need to understand moving forward.

An article published on September 1, 2021 by the AGC also describes workforce shortages that are in line with pre-pandemic levels. Construction firms are struggling to find qualified worker to fill needed positions that will no doubt lead to shortages and increased labor costs moving into 2022. How much of an impact from a cost inflation standpoint will this represent is to be determined, but it is impactful enough that our industry needs to continue to monitor.

As we move forward into 2022, the indicators that we track suggest that construction costs will continue to increase beyond the traditional annual inflation rate upticks. We are cautiously optimistic that with the spotlight shining so brightly on this issue, as we move toward mid-term elections, legislators from both sides of the aisle will focus on solutions to the global supply-chain disruptions, labor shortages and control measures for minimizing the impact of the pandemic.